Superior wealth protection and risk management services including captive design and end of life tax free reorganization services

Captive Domicile Selection

Domicile Information

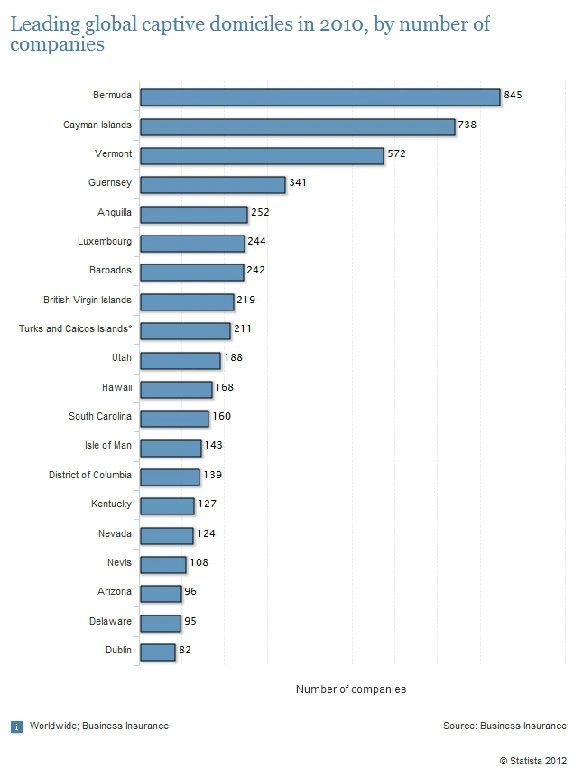

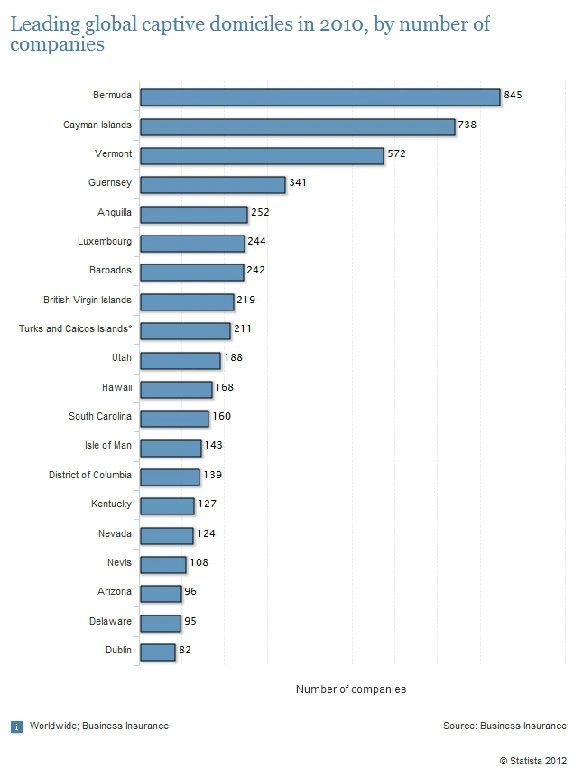

There are nearly 100 domiciles in the world licensing captives today, over 30 of which are now US states. Be sure to visit our domicile specific pages part of this website for detailed information, much of it exclusive to this site, on leading domiciles.

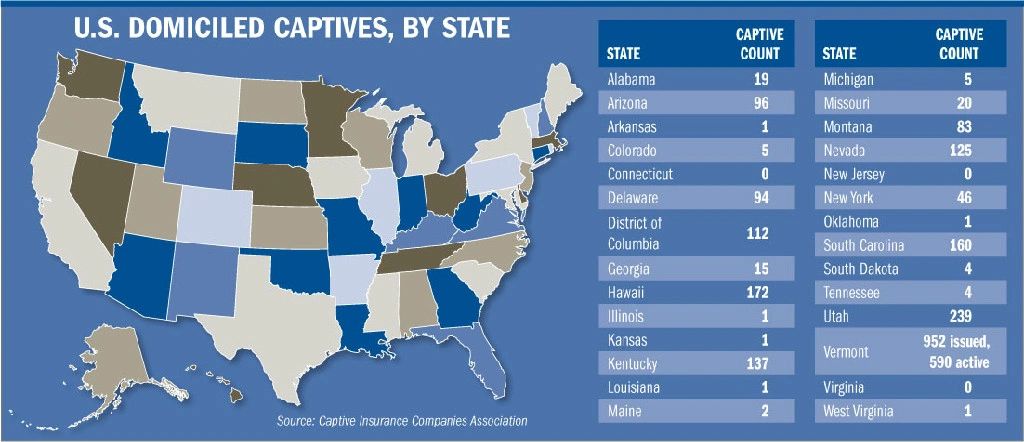

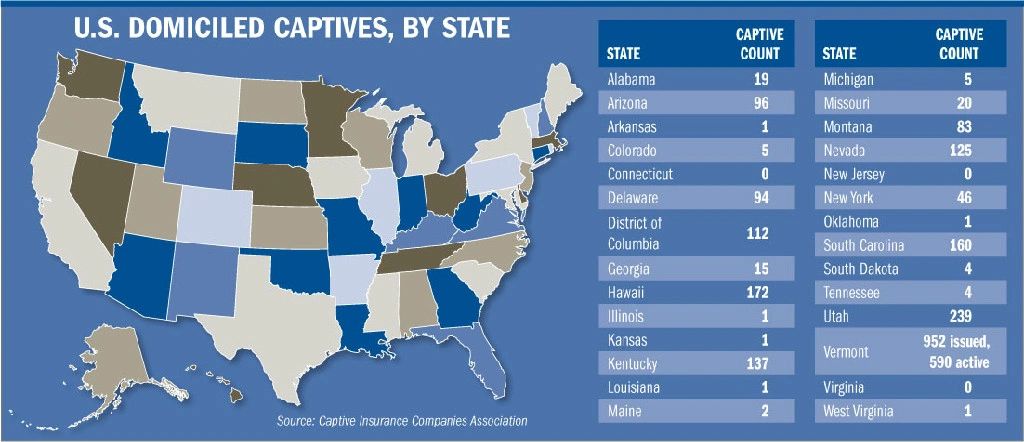

Of the 30 or so US states that now license captive insurance companies, the following chart shows how many they reported to have licensed as of 2012:

The above numbers change rapidly. For example, as of early 2014, Vermont had over 1,000 licensed captives, Montana over 175 (including cells/series), Utah over 250 (with cells/series), and Delaware and Anguilla approaching 400 (with cells/series). Even Puerto Rico, a relative newcomer, has over 100 captive entities in its regulatory stable. And it appears the Bahamas succeeded recently developing new strategic relationships fueling its growth.

Choice of domicile impacts many things including types of captive business plans allowable, minimum start-up capital and surplus required, the level of regulatory compliance requirements and supervision, investment discretion, frequency and costs of regulatory examinations, and varying levels of fees, costs and applicable taxes. As highlighted in our Managing Director's "Captive Best Practice Innovations" article published April 2014 in Captive Review, domicile relationships and rules change often and every captive must be prepared for dramatic change in quality of the relationship as a domicile's growth impacts its service level and expertise; every captive must maintain best practice standards whether the domicile requires them or not, and every captive should be prepared to change its domicile partner and even possibly its manager during its life cycle.

Domicile Costs and More Info ...

Generally speaking forming a captive onshore in the US is more expensive to start and to operate in subsequent years than many older more experienced offshore domiciles. The main reason for the increased cost and regulatory burden on private captive insurance companies in the US is due to the National Association of Insurance Commissions (NAIC), a self regulatory body that each state insurance department is a member of, preventing states from being innovative. State captive statutes look similar. The NAIC has committees to create model rules - most states simply adopt them and lack internal expertise and political will to improve them.

Most captive enabling states do not even have dedicated experienced captive staff. For this reason, despite the stigma and increased uncertainty of forming your captive offshore, offshore remains an attractive option for some captive applications.

Some US states in 2013 have enacted new legislation of importance. Montana is targeting the success of Delaware's SBU series captive program. Texas also passed legislation in June 2013 to start accepting existing captive applications to redomesticate to Texas if they insure Texas based risks. Rules are anticipated by end of 2013, and in 2014 they may start accepting new captive applications. If California were better managed, it would be licensing captives as well.

When you hear about offshore domiciles not requiring audits or actuary reports, be cautioned that US taxed captives (like 831(b) captives), should nevertheless incur these expenses and follow best practice US standards. Minimum capital also should relate logically to risk premium levels, not just meet minimum offshore domicile requirements. We have our own opinion on what this capital to premium ration should be, and the best methods to increase surplus reserves over time as the captive design assumes greater enterprise risk.

Click here to read a June 2013 Captive Review article on Met Life bringing its Bermuda captive onshore and the underlying reasons. Industry benchmark reports in 2013 confirm US domiciled captives are increasing, however re-domestication of offshore US owned captives to onshore is not a prevalent trend despite the majority of US states now licensing captives. European owned captives domiciled outside the EU are also not redomesticating in any meaningful numbers despite more EU nations now licensing captives. Its fair to say that if you have a good domicile relationship its best to keep it as long as possible.

The above numbers change rapidly. For example, as of early 2014, Vermont had over 1,000 licensed captives, Montana over 175 (including cells/series), Utah over 250 (with cells/series), and Delaware and Anguilla approaching 400 (with cells/series). Even Puerto Rico, a relative newcomer, has over 100 captive entities in its regulatory stable. And it appears the Bahamas succeeded recently developing new strategic relationships fueling its growth.

Choice of domicile impacts many things including types of captive business plans allowable, minimum start-up capital and surplus required, the level of regulatory compliance requirements and supervision, investment discretion, frequency and costs of regulatory examinations, and varying levels of fees, costs and applicable taxes. As highlighted in our Managing Director's "Captive Best Practice Innovations" article published April 2014 in Captive Review, domicile relationships and rules change often and every captive must be prepared for dramatic change in quality of the relationship as a domicile's growth impacts its service level and expertise; every captive must maintain best practice standards whether the domicile requires them or not, and every captive should be prepared to change its domicile partner and even possibly its manager during its life cycle.

Domicile Costs and More Info ...

Generally speaking forming a captive onshore in the US is more expensive to start and to operate in subsequent years than many older more experienced offshore domiciles. The main reason for the increased cost and regulatory burden on private captive insurance companies in the US is due to the National Association of Insurance Commissions (NAIC), a self regulatory body that each state insurance department is a member of, preventing states from being innovative. State captive statutes look similar. The NAIC has committees to create model rules - most states simply adopt them and lack internal expertise and political will to improve them.

Most captive enabling states do not even have dedicated experienced captive staff. For this reason, despite the stigma and increased uncertainty of forming your captive offshore, offshore remains an attractive option for some captive applications.

Some US states in 2013 have enacted new legislation of importance. Montana is targeting the success of Delaware's SBU series captive program. Texas also passed legislation in June 2013 to start accepting existing captive applications to redomesticate to Texas if they insure Texas based risks. Rules are anticipated by end of 2013, and in 2014 they may start accepting new captive applications. If California were better managed, it would be licensing captives as well.

When you hear about offshore domiciles not requiring audits or actuary reports, be cautioned that US taxed captives (like 831(b) captives), should nevertheless incur these expenses and follow best practice US standards. Minimum capital also should relate logically to risk premium levels, not just meet minimum offshore domicile requirements. We have our own opinion on what this capital to premium ration should be, and the best methods to increase surplus reserves over time as the captive design assumes greater enterprise risk.

Click here to read a June 2013 Captive Review article on Met Life bringing its Bermuda captive onshore and the underlying reasons. Industry benchmark reports in 2013 confirm US domiciled captives are increasing, however re-domestication of offshore US owned captives to onshore is not a prevalent trend despite the majority of US states now licensing captives. European owned captives domiciled outside the EU are also not redomesticating in any meaningful numbers despite more EU nations now licensing captives. Its fair to say that if you have a good domicile relationship its best to keep it as long as possible.

Minimum Capital and Surplus Requirements (the #s below may be dated):

Note minimum domicile required capital for licensing is likely not the minimum capital appropriate for your captive business plan:

Alabama ($250,000)

Anguilla ($10,000 to $200,000)

Antinue ($250,000)

Arizona ($250,000)

Barbados ($125,000)

Belize ($25,000)

Anguilla ($10,000 to $200,000)

Antinue ($250,000)

Arizona ($250,000)

Barbados ($125,000)

Belize ($25,000)

Bermuda ($120,000)

British Columbia ($200,000)

BVIs ($100,000)

California (does not yet license captives as of 2013)

Cayman Islands ($120,000)

Colorado ($500,000)

Cook Islands (not yet analyzed)

Curacao (varies)

BVIs ($100,000)

California (does not yet license captives as of 2013)

Cayman Islands ($120,000)

Colorado ($500,000)

Cook Islands (not yet analyzed)

Curacao (varies)

Delaware ($250,000)

District of Columbia ($250,000)

Florida ($250,000 - began licensing captives in July 2012)

Georgia ($500,000)

District of Columbia ($250,000)

Florida ($250,000 - began licensing captives in July 2012)

Georgia ($500,000)

Hawaii ($250,000)

Hong Kong ($100,000)

Illinois ($1,000,000)

Guam ($120,000)

Hong Kong ($100,000)

Illinois ($1,000,000)

Guam ($120,000)

Kentucky ($250,000)

Mauritius

Micronesia ($1,000,000)

Missouri ($250,000)

Mauritius

Micronesia ($1,000,000)

Missouri ($250,000)

Montana ($250,000 regular - $125,000 reinsurance captive)

New Jersey ($250,000)

New York ($250,000)

New Jersey ($250,000)

New York ($250,000)

Nevada ($200,000 )

Nevis ($10,000 to $185,000 - note reinsurers begin at only $75,000)

North Carolina (new legislation in 2013 not yet reviewed)

Oklahoma ($150,000 pure 1st year provided $250k by end of 1st year)

Oregon ($250,000)

Panama ($150,000) - learn about Panama tax and captive law by clicking here.

Qatar ($150,000)

Samoa

Seychelles ($5,000)

South Carolina ($250,000)

South Dakota ($200,000)

St. Lucia ($50,000)

St. Vincent ($10,000)

Tennessee ($250,000)

Texas (passed legislation in June 2013 and rules anticipated by end of November - initially will only re-license and re-domesticate to Texas already operating out of state or offshore captives, not license newly created captives)

US Virgin Islands ($50,000)

North Carolina (new legislation in 2013 not yet reviewed)

Oklahoma ($150,000 pure 1st year provided $250k by end of 1st year)

Oregon ($250,000)

Panama ($150,000) - learn about Panama tax and captive law by clicking here.

Qatar ($150,000)

Samoa

Seychelles ($5,000)

South Carolina ($250,000)

South Dakota ($200,000)

St. Lucia ($50,000)

St. Vincent ($10,000)

Tennessee ($250,000)

Texas (passed legislation in June 2013 and rules anticipated by end of November - initially will only re-license and re-domesticate to Texas already operating out of state or offshore captives, not license newly created captives)

US Virgin Islands ($50,000)

Utah ($250,000)

Vanuatu ($25,000 but varies)

Vanuatu ($25,000 but varies)

Vermont ($250,000)

As a general rule, US companies today most often select a US state to form and regulate their captive insurance company ("CIC").

Offshore domiciles are chosen for many applications because established offshore domiciles have extensive captive experience, allow lower initial capital in many cases, are more flexible about qualifying capital assets, and have lower ongoing fees and taxes than US domiciles.

However, there now are several US based cell captives and series captives that do allow new participants to join for less initial capital and lower ongoing expense than possible by forming a new pure captive in the US. These cell and series captives are increasingly competitive alternatives to offshore domiciles.

Top US and Offshore Domiciles to Consider for Small Captive Insurance Companies

In 2011, Utah and Delaware led new US captive formations. Anguilla led among offshore domiciles. These numbers do not tell the whole story. Delaware added an even greater number of SBU captives as part of its existing Series LLC approved captive structures. Most of these SBUs were small 831(b) captive applications.

As 2012 came to a close, both Delaware and Anguilla saw record numbers of new captive formations (and likely led all domiciles). Delaware also experienced continued rapid expansion of its SBU program due to the lower initial capital requirements for an SBU over a pure captive.

For detailed information on offshore domiciles from legal system, econimic activity and status, currency and form of government, visit the US CIA Fact Book by clicking here.

Contact Us for current domicile recommendations for your project.

Key Captive Domicile Selection Considerations

Selecting the best domicile for your captive is perhaps the most important decision to make. There is no one best domicile for all applications. Key considerations in selecting the best domicile include:

An area of complexity often ignored impacting domicile selection is retaliatory premium taxes (RPTs). RPTs are levied by states on risks in those states that are insured by out of state insurers including "foreign" captives. Much is unsettled in this area. Click here to learn about Retaliatory Self Procurement Captive Premium Taxes.

As states increase their efforts to find new revenue, many captive owners who domicile captives outside of their "home state," surprises including significant late payment penalties and interest may be on the horizon. Title 5 of the recent US Dodd-Frank Act attempts to simplify this area for large companies with operations in many states, but it will literally be years before uncertainties are adequately addressed.

- Will the domicile regulators allow your captive business plan and ownership structure;

- Will the domicile be cooperative on loan, dividend and other capital transaction decisions that changing business conditions may require (access and control over captive surplus reserves without unnecessary "red tape" or restrictions as practices vary greatly between onshore domiciles in particular; most offshore domiciles with more experience are often easier to work with);

- What is the minimum required capital (this ranges from $10,000 to $250,000 or more depending on how well you know all your options - regardless of the domicile minimum (which could even be zero if you are joining an existing cell or series program), some meaningful base capital and surplus is advised if the tax implications are of concern. When starting with minimal capital as often happens to be able to afford a CIC, if possible earnings should be retained until capital and surplus approach the general insurance industry practice of a 3:1 ratio of premiums to base capital and surplus reserve);

- What are the application fees and approval timeline;

- What are the premium taxes and renewal fees;

- Are there any other applicable taxes and fees on operations and income?

- Are there hidden costs if you select a domicile other than where the insured business headquarters is? (See RPT white paper referenced below)?

- What are the financial disclosure and audit requirements and frequency variances between domiciles?

- What are the actuarial report requirements?

- What examinations are expected and are they charged for or included in the base annual fees?

- What are the asset investment restrictions, loan restrictions and dividend restrictions or procedures?

- What are the resident director, service provider and meeting requirements?

- Must you open a bank account in the selected domciile and if yes what balance must be maintained?

- What are the wind-up procedures and costs and timeline?

An area of complexity often ignored impacting domicile selection is retaliatory premium taxes (RPTs). RPTs are levied by states on risks in those states that are insured by out of state insurers including "foreign" captives. Much is unsettled in this area. Click here to learn about Retaliatory Self Procurement Captive Premium Taxes.

As states increase their efforts to find new revenue, many captive owners who domicile captives outside of their "home state," surprises including significant late payment penalties and interest may be on the horizon. Title 5 of the recent US Dodd-Frank Act attempts to simplify this area for large companies with operations in many states, but it will literally be years before uncertainties are adequately addressed.

Most consultants and captive managers have some combination of conflicts of interest or lack of current expertise with all domiciles options. This is an ever changing landscape. Legislative, staff and capacity changes occur within every domicile and they often impact what captive business they will entertain and the level of service and efficiency you can expect when doing business with them. And captive innovation is driving rapid change within the industry. Some domiciles welcome innovation and are taking a pro business development approach; others are not and will be slow to recognize the blurring line between traditional and captive insurance application.

Your decision of which service provider to work with will likely impact the domicile decision more than you might think even though in a perfect world it should not. The best decision is possible only after sufficient due diligence by a requisite expert free of conflicts of interest. If you find yourself in a less than ideal domicile, changing domiciles is not that difficult or expensive and occurs more frequently than you might suspect.

Detailed Information and Exclusive Interviews with Domicile Regulators

If you peruse all of this site, you will come to understand just how complex the domicile decision actually is, especially now that over 30 US states authorize captives. And offshore jurisdiction considerations are increasingly impacted by federal level US, EU states and other foreign authority regulatory decisions.

Our exclusive interviews with many jurisdiction senior officers are very informative and enjoyable to watch - they are a good starting point to understanding the domicile choice decision. Visit our Captive Event Coverage page to find most of the video links.

Domicile Decision Background - On or Offshore Considerations

Bermuda and the Cayman Islands led the way in creating the captive insurance industry. They remain home to more captives than any other domiciles unless you aggregate all of the U.S. states that now have captive enabling legislation. Vermont led the way as the first U.S. state to promote captive insurance companies. Now more than 30 other states have authorized captives and are promoting captive business formations within their states. There are pros and cons to selecting each particular domicile.

Although the US is "cracking down" on offshore captives, there remains significant and sometime unique benefits for many US companies to have offshore as well as onshore captive structures. Very popular recently within the US is the promotion of use of the U.S. Internal Revenue Code special small insurance company 831 (b) election which exempts operating income from U.S. federal income tax. If a 831(b) qualifying captive is formed in a non-income tax state such as Nevada, all if its operating income can accumulate income tax free.

For U.S. based companies and organizations, there is increasing pressure to form U.S. domiciled captives. Many older "offshore" captives have changed domiciles to the U.S. (repatriated) as much from stigma and fear as legal, tax and financial reasons. Once you decide to participate in captive insurance, determining whether to domicile on or offshore is step one.

The primary reasons for domiciling offshore remain lower income and other taxes, reduced regulatory costs, and third party risk underwriting flexibility. It is also common for onshore captives to cede risk and re-insure exposures to offshore captives, often a related offshore captive. Direct writers of insurance within the US are also discovering the strategic use of offshore reinsurance captives can increase their capacity to write more business and accelerate profit growth. Leveraging jurisdictional rule variations is now quite a science with substantial benefits to those in the know.

The primary reasons to domicile "onshore" include legal requirements (such as U.S. Department of Labor requiring ERISA benefits to be domestically insured), underwriting and regulatory advantages offered risk retention groups, and improved certainty of income and excise tax positions and reporting for U.S. owners. New changes part of the Dodd Frank Act that took effect in July 2011 also impact US domicile choice for those insureds desiring to minimize otherwise applicable nonadmitted and reinsurance premium taxes. Additional US federal changes are likely coming that may increase the need to have at least some "fronting" US based captives to minimize overall costs of your captive program.

US "New Wave" Domicile Competition

Vermont, South Carolina and Hawaii emerged as the leading 3 US domiciles due to a lack of competition for many years. More recently, Arizona, Nevada, Delaware, Utah, Montana, Kentucky and many other states are now aggressively competing for captive business. If you can clearly make your case, and have a solid financial position, there is great room for innovation in captive business model scope. Expect to see more profit center oriented captive applications emerge in coming years including expansion into "affinity group" 3rd party risk programs.

The majority of U.S. states now authorize captive insurance companies. Many of these states have small if any dedicated captive regulatory staff, but the increased competition is attracting more interest in the use of captives and every interested state is seeing activity and processing captive insurance company applications. There has never been a better climate for forming and operating a captive insurance company.

More Domicile Information and Comparative Domicile Evaluation Tools

For an easy to understand and informative way to start comparing one domicile option to another, visit the Captive Insurance Companies Association (CICA) site's dynamic side-by-side comparison tables by Clicking Here. To review a directory of specific domicile websites and statutes, click here.

Making the correct domicile selection requires a far more detailed evaluation than these simple comparative tables suggest. And the regulatory landscape is changing quickly and not necessarily reflected correctly let alone comprehensively on websites.

Please also review our featured articles introducing more advanced captive design and domicile selection issues as well as other hot topics you need to be aware of.

Making the best domicile selection is challenging. It requires analysis and familiarity with each domicile's nuances. Most advisors are familiar with only a handful of domicile options. Important consideration must be given to costs, however costs are merely the starting point and one piece of the puzzle. Business plan scope and change flexibility, operational and regulatory compliance complexity, and investment portfolio allocation and management discretion are also very important considerations. Remember, forming a captive is not simply a cost containment or cost reduction decision. Selecting the best captive designers, skilled cost effective managers, and operating from the optimal domicile should create a valuable new business and profit center.

By engaging an industry expert to help with your captive feasibility study, the domicile selection issue as well as many others will be analyzed.

Captives can also provide attractive wealth accumulation and wealth transfer attributes as ancillary side benefits.

By engaging an industry expert to help with your captive feasibility study, the domicile selection issue as well as many others will be analyzed.

Captives can also provide attractive wealth accumulation and wealth transfer attributes as ancillary side benefits.