Superior wealth protection and risk management services including captive design and end of life tax free reorganization services

Captive Investment Strategy

Captive investments are usually regulated by licensing domicile officials as well as your captive manager's particular investment policy. Some jurisdictions only look for likely solvency needs, not worse case scenarios, and allow you wide investment discretion. Some managers require more conservative investment policies and practices than the domicile regulators will allow. Basic guidelines are the assets invested in must allow needed liquidity to meet claims and operating expenses. Also no more than 10% of assets should be in any one investment as diversification is encouraged. As high as 25% investment concentrations may be OK but approval should be sought first.

If you want your captive to be a family bank and loan money to related parties, invest in business equipment and lease it to insured companies, and invest in income producing real estate or other illiquid securities or bank instruments, be careful where you domicile you captive and who manages it.

Life insurance investment by captives has always been a hot topic. While generally allowable, prior approval should always be sought, the % of assets invested in life insurance should be reasonable, and death benefits should go to the captive if you want to avoid potential serious problems.

High cash value life products provide good tax deferred returns and used conservatively within a captive can makes sense and should be allowable by most domiciles, even counted partially towards solvency requirements. Captives with life insurance investment have been audited by the IRS and provided tax avoidance goals are not evident, and the % of assets in such investments reasonable, these have been allowed.

Click here for a really good article on related discussions surfacing in April 2014 after a well known captive industry lawyer published an article in Forbes online criticizing investment in life insurance by captives.

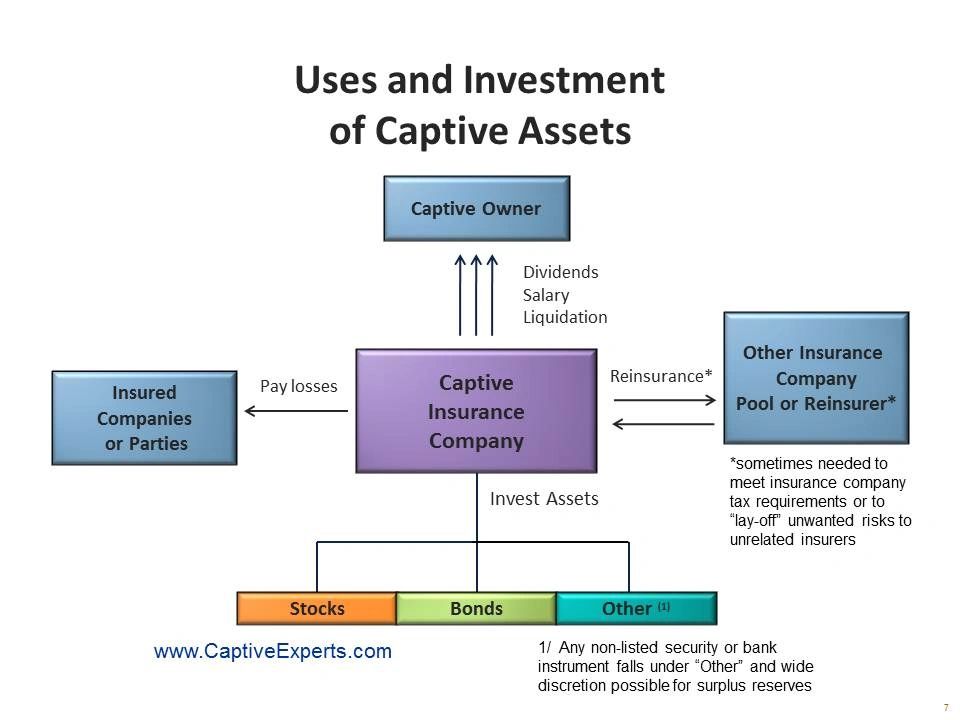

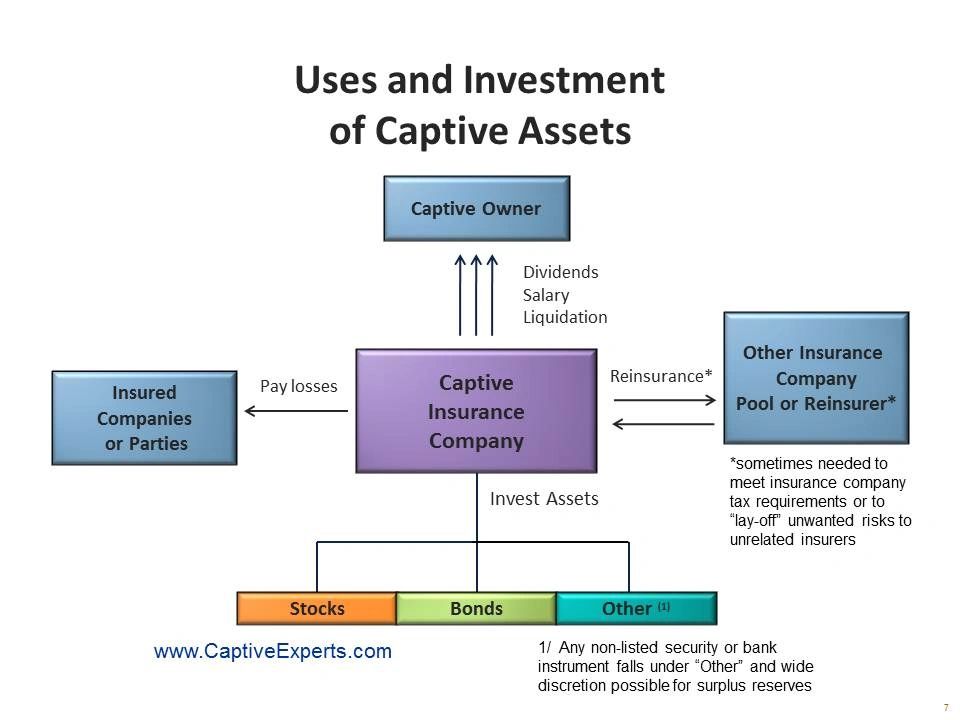

Here is a captive insurance diagram showing a typical captive investment portfolio of bank and listed security investments, as well as other typical flows of cash into and out of a captive:

If you want your captive to be a family bank and loan money to related parties, invest in business equipment and lease it to insured companies, and invest in income producing real estate or other illiquid securities or bank instruments, be careful where you domicile you captive and who manages it.

Life insurance investment by captives has always been a hot topic. While generally allowable, prior approval should always be sought, the % of assets invested in life insurance should be reasonable, and death benefits should go to the captive if you want to avoid potential serious problems.

High cash value life products provide good tax deferred returns and used conservatively within a captive can makes sense and should be allowable by most domiciles, even counted partially towards solvency requirements. Captives with life insurance investment have been audited by the IRS and provided tax avoidance goals are not evident, and the % of assets in such investments reasonable, these have been allowed.

Click here for a really good article on related discussions surfacing in April 2014 after a well known captive industry lawyer published an article in Forbes online criticizing investment in life insurance by captives.

Here is a captive insurance diagram showing a typical captive investment portfolio of bank and listed security investments, as well as other typical flows of cash into and out of a captive:

Background on Captive Investments

In a captives early years, investments should be kept relatively conservative and tailored towards fixed income producing, at least for the vast majority of investment assets. As the captive's loss reserves build, more aggressive and illiquid investments are not uncommon. Related party loans and dividend distributions are also considered by year 3 in many cases. Captives have also been known to invest in affiliated operating businesses, finance expansions, and purchase and leaseback key equipment.

For US and European Union captives, the trend is toward increased uniformity of regulations including investment restrictions and reporting.

Most new captive owners are new to managing a captive insurance company portfolio. Historically captives used bank partners and investment advisers managing fixed income portfolios weighted in liquid high rated bonds.

More recently, captive investments are well diversified with a range of risk represented by the portfolio, and more recently alternative investments from related party loans to equipment purchase and leaseback to real estate.

In September 2011, our managing director published a related article in the Captive Review (an industry leading magazine and conference sponsor on the global captive industry) discussing the historical interest rate intervention by the fed reserve banks unlike anything in history. This combined with record deficit spending creates an environment for future interest rate rises of significance that will cause increasing yields and declining values of fixed income investments.

Insurance reserve investment portfolios need to be actively managed accordingly, not follow historical practices. Click here to read our Managing Director Tom Cifelli's full investment article, a shortened version of which was published in Captive Review's July 2011 issue.

Insurance reserve investment portfolios need to be actively managed accordingly, not follow historical practices. Click here to read our Managing Director Tom Cifelli's full investment article, a shortened version of which was published in Captive Review's July 2011 issue.

- Who are the investment managers focused on Captive investments?

- What investment strategies are these professional captive investment portfolio managers deploying today?

- Find out in our white paper released in July 2011

Conflict of interest investments require special consideration but are allowable in many circumstances. Managing a captive's investments, and creative use of its loan and dividend processes can give a captive owner and its affiliated insured businesses a fun tool chest found historically only among the most sophisticated and well represented super ultra rich families (9+ figure family net worths).

For captives programs integrated with advanced estate and wealth transfer strategies, specialized insurance products and other privately placed and design security investments are sometimes integrated., even controlling interests in operating businesses.

More Information

Visit our articles and white papers discussing captive insurance company investment portfolio options and strategies and other breaking industry topics.

***********************

Article Excerpt reprinted with some edits:

“A September tapering is certainly possible. I think that is going to depend on the data,” said Goldman’s chief economist, Jan Hatzius. Long time ALERT readers know that I believe the key to understanding current Fed policy views is to watch the comments of Fed vice-chair Janet Yellen. Other Fed members and presidents of regional banks may generate more headlines, but, if you want to know what the policy steps are likely to be, pay attention to Yellen speeches.

Which brings me to Williams. Before becoming vice-chair, Yellen was president of the SF Fed branch. She is close to her successor in that position, Williams. Williams appears to talk the same game as Yellen. He's getting the perspective from Yellen, is my guess.

Thus, it is noteworthy that on Monday Williams said that "an improving U.S. economy would allow the Federal Reserve to pare back its stimulatory bond buying in the summer."

"It really is a question for me of watching for continuing signs in the U.S. labor market, continuing signs of more greater confidence in the momentum in the U.S. economy, but also watching carefully where the underlying inflation rate is and what the outlook for inflation is," Williams told reporters during a visit to Sweden. This is the same view he expressed in a speech in April, that the bond buying program could slow by the end of the year.

If this is what Yellen and Bernanke are thinking, and they likely are, then it is possible that during this current stock market topping activity they will start the Great Taper. Once that occurs, the great interest rate climb goes into phase two. The bottom in rates appears to have already passed. I repeat this is no time to be in bonds or high yielding stocks, this is very likely the start of a multi-year climb in rates."

Source: EPJ

**************************

***********************

June 2013 Alert - Interest Rate Rise and Increasing Maturity Spreads is Finally Here

Article Excerpt reprinted with some edits:

“A September tapering is certainly possible. I think that is going to depend on the data,” said Goldman’s chief economist, Jan Hatzius. Long time ALERT readers know that I believe the key to understanding current Fed policy views is to watch the comments of Fed vice-chair Janet Yellen. Other Fed members and presidents of regional banks may generate more headlines, but, if you want to know what the policy steps are likely to be, pay attention to Yellen speeches.

Which brings me to Williams. Before becoming vice-chair, Yellen was president of the SF Fed branch. She is close to her successor in that position, Williams. Williams appears to talk the same game as Yellen. He's getting the perspective from Yellen, is my guess.

Thus, it is noteworthy that on Monday Williams said that "an improving U.S. economy would allow the Federal Reserve to pare back its stimulatory bond buying in the summer."

"It really is a question for me of watching for continuing signs in the U.S. labor market, continuing signs of more greater confidence in the momentum in the U.S. economy, but also watching carefully where the underlying inflation rate is and what the outlook for inflation is," Williams told reporters during a visit to Sweden. This is the same view he expressed in a speech in April, that the bond buying program could slow by the end of the year.

If this is what Yellen and Bernanke are thinking, and they likely are, then it is possible that during this current stock market topping activity they will start the Great Taper. Once that occurs, the great interest rate climb goes into phase two. The bottom in rates appears to have already passed. I repeat this is no time to be in bonds or high yielding stocks, this is very likely the start of a multi-year climb in rates."

Source: EPJ

**************************