Main Navigation

- Home

- Captive Formation Steps

- Captive Fees & Costs

- Captive Assessments

- Captive Books

- Captives 101

- Captive FAQs

- Captive Pros and Cons

- Captive Domicile Choices

- More Captive Services

- Captive Types

- Captive Taxation

- Captive Management

- Captive Investments

- Featured Articles

- More Resources

- Risk Management

- Captive Event Coverage

- Anguilla Captives

- Bermuda Captives

- Delaware Captives

- Nevada Captives

- Utah Captives

- Vermont Captives

- Wealth Protection

- Disclaimer

- About Us

- Contact Us

Captive Insurance Taxation

This page and the subpages part hereof or linked to it lay out nearly every significant tax related issue in language anyone can understand if they take the time to read all this material.

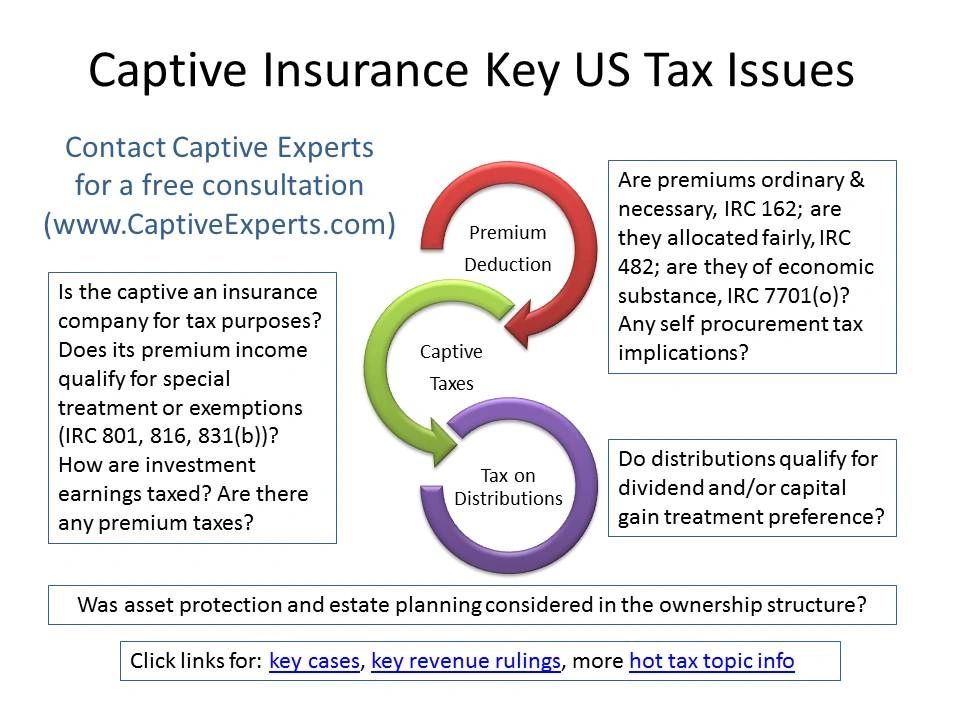

The major US tax issues impacting the formation and operation of a captive insurance company are summarized as follows:

- Is your captive designed correctly to meet the IRS requirements for insurance companies, most notably the IRC section 831 elements?

- Does it meet the definition of an insurance company and the IRS safe harbor rulings on risk distribution and shifting?

- Does your captive and its business relationship to affiliated insured companies meet the new Economic Substance test part of the 2010 Affordable Care Act?

- Will your captive design, operations, loans and dividend practices cause exposure to 26 U.S.C. section 482 re-allocation of income and deductions among controlled entities?

- Are the premiums paid by affiliated insured operating companies reasonable and necessary and fully deductible under IRC sections 162 and 482?

- If the IRC section 831(b) election making the captive premium income free of US income taxation is important, has it been made correctly and its requirements satisfied?

- If IRC section 501(c) (15) is being relied upon, does your captive design meet the requirements for its income to be exempt from tax?

- If you elected to form an offshore captive, does it qualify for and have you properly made the 953(d) election to have the captive taxed as a US company?

- What are the concerns and penalties if your offshore captive blows its 953(d) election either by not making it correctly or it being disqualified?

- Does the FATCA (Foreign Account Tax Compliance Act) part of HIRE (2010 Hiring Incentives to Restore Employment) require your captive file the new form W-8BEN or other forms, and is it exempt from withholding?

- Have you designed the ownership of your captive correctly to minimize gift and estate taxes?

- How can you operate and wind-up your captive to minimize income taxes?

- How does domicile selection impact tax obligations and exposures of the captive?

- Click here to read a May 2014 ruling by the US IRS impacting treatment of employee benefit captives, a hot topic in the industry

- Click here to read IRS Private Letter Ruling from January 2014 approving extended warranty captive with good summary of applicable tax law at issue

- Here is a comprehensive current slide show highlighting all hot tax topics as of January 2014 - this presentation was by leading tax lawyers and IRS general counsel staff

- Captive taxation primer (good overview)

- March 12, 2014 IRS memo about consequences to offshore captive if its 953(d) election to be taxed as US insurance company is disallowed

- Some basic captive tax audit guidelines shared by the IRS to give you an idea as to what they may look at if they examine your captive

- 831(b) Captive Tax and Planning Primer (small insurance companies the US allows a special election to exclude all underwriting income from US income tax)

- 831(b) article and case study from Journal of Accountancy, April 2013

- Captive Tax Case Law Summary (all major court cases impacting formation and operation and taxation of captives)

- Estate Planning & Captives Primer (summary of potential asset protection, estate planning and wealth transfer benefits achievable with proper captive ownership planning)

- New Codified US Economic Substance Test and Impact on Captives

- State Self Procurement Premium Taxes (Retaliatory Premium Tax Controversy Applied to Captives - (If a state has an applicable statute governing non-admitted captives, whether they can levy and collect them from an out of state domiciled captive, and if not due to a lack of minimum constitutional nexus, whether they can levy and collect them against the insured businesses in the state)

- Premium Deduction Issues - IRS Rev Rul 2008-8 (most recent IRS pronouncement summarizing how they analyze whether or not your captive premiums are deductible insurance expenses)

- IRS Analysis & Viewpoint - Is Your Captive Really an Insurance Company - IRS Notice 2003-34

-

Special Insurance Company Tax Rules

Governments worldwide offer tax incentives to encourage setting aside savings to address claims of 3rd parties who suffer loss. In the USA, small insurance companies may exclude from income all premium revenue if they qualify for the special 831(b) election.

Dividends and wind-up distributions are taxed at lower rates then the deduction value of premiums paid to your captive. In combination with the many other business and economic benefits of owning a captive, these tax rules create significant cash flow benefits of owning a captive insurance company, particularly if you experience low claims losses.

Designed and operated correctly, captives provide substantial wealth creation, protection and transfer benefits.

For successful closely held family businesses and self-employed professionals, the income, business succession and estate planning potential of captives are compelling.

Nevertheless most business, financial and tax advisers today still do not truly understand captives. Over 90% of Fortune 500 companies use captives today (See History of Captives), yet less than 5% of mid-market companies do. This is purely due to lack of expertise within their advisory and management teams as captives make sense for much smaller companies than generally understood.

Most Widely Understood Insurance Tax Accounting Benefit

Insurance company accounting and tax rules deviate from typical tax period accounting and recognition assumptions. They reflect the fact that claim expenses associated with premium payments usually occur in different accounting periods, sometimes many years removed from each other. They also recognize asset reserves must be built up to support an ability to pay high coverage limits in the event of loss.

As a result, the general rule is that business insurance premiums are deductible when incurred, yet the insurance company is not subject to ordinary income recognition rules on the premiums. This allows for a deferral of tax to future periods to encourage insuring against risks and keep the cost of doing so reasonable. This helps protect the public by creating pockets of savings to draw upon to address otherwise devastating expenses.

For small insurance companies (under $1.2 million in annual premium) that qualify for the special 831(b) tax election, income tax on premium underwriting income is not just deferred but not subject to federal income tax whatsoever; premiums received by qualifying 831(b) small insurance captives are exempt from US federal income tax. This is an extraordinary tax advantage with amazing planning implications yet little understood even among lawyers and accountants who consider themselves tax experts.

Justification for Extending Beneficial Taxation Rules to Captive Insurance Companies

Until 2001 (explained below), the US Internal Revenue Service routinely challenged application of favorable insurance company rules to captive insurance companies due to their belief the related party aspects and lack of arm's length negotiations caused captive transactions to run afoul of economic substance requirements for favorable tax treatment.

Insurance Company Taxation Overview

Tax law is extremely complex. The following information is not tax advice, and should not be relied upon whatsoever. It is offered merely for discussion purposes to give you a framework for assessing many of the tax related issues facing captive insurance companies.

This discussion focuses on summarizing the U.S. federal income tax aspects unique to captive insurance companies. Economic substance (business purpose), attribution and "arm's length" doctrine requirements applicable to all business transactions also apply but are not covered in detail below.

State laws vary. Some states like Florida, Texas and Nevada do not have income taxes at all. Others like Utah, Montana and Delaware exempt captives from corporate income tax. Foreign captive insurance companies operate under different rules of course unless they have elected (IRC section 953 election) to be subject to US taxation. Tax treaties exist between various governments which override the otherwise applicable jurisdictional tax rules.

U.S. Supreme Court Background (See "Summary of Key Law Cases" below)

The United States Supreme Court in Helvering v. LeGierse, decided in 1941, established the framework for what is insurance, and therefore deductible when paying a premium while allowing accelerated deductions for future loss reserves, as opposed to being merely a form of self-insurance which does not have any special tax benefits. The Helvering case established rules requiring risk “shifting” and risk “distribution.” The court ruled that if the risk of loss is not shifted from one party to another, then it is not insurance qualifying for special tax treatment.

Many court cases have added depth and complexity to the analysis. Most of these disputes arose due to the IRS enacting restrictive revenue rulings such as 77-316 attempting to limit the application of the principles emerging from Helvering and related cases. Some major decisions between taxpayers and the IRS on this long road to some stability and consensus on taxation of captive insurance companies include Humana (1989), Gulf Oil (1990), Americo (1991), Harper (1992) and Hospital Corp of America (2004). The battle in these cases was whether a captive insurance company was designed to sufficiently meet the risk shifting and risk distribution requirement to receive beneficial tax treatment. The IRS lost on most issues throughout this series of cases.

Internal Revenue Code and Regulations

The rules and principles debated and decided upon in the above court cases governing captive insurance company income taxation interpretation have now primarily been “codified” in statutes and regulations and IRS revenue rulings. Reasonable frameworks that can be safely navigated in designing and operating a captive insurance company are emerging.

Internal Revenue Code Section 501 (c) (15)

This allows very small insurance companies (under $600,000 in gross receipts with the majority from premium income) to be tax-exempt. The IRS may move to eliminate this special exemption. Recent changes have made it impractical for nearly all applications. Click here to read an explanation why.

Internal Revenue Code Section 831(a) and 831(b)

These code sections govern general insurance company taxation and the election available under 831 (b) for small captive insurance companies is very important. It is a safe harbor allowing captive insurance companies with less than $1.2 million in annual written premium to be taxed on investment income alone. This greatly simplifies how these small captive insurance companies compute taxable income. 831(b) captives are growing in popularity as the flexibility of design, structure and use is better understood. Many captives formed today are 831(b) captives owned by successful family businesses. The 831(b) captive effect is to shelter up to $1.2 million per year in what might otherwise be taxable income to the operating business with these pre-tax dollars set aside and accumulating to protect against losses and facilitate business succession planning when structured properly. See Tax Articles for more information on how to correctly design and implement a valid 831(b) captive.

IRS Concedes in 2001 on Important Captive Industry Tax Issues

Prior to Revenue Ruling 2001-31, the IRS took the position that brother-sister company transactions were not arms-length “risk shifting,” and special tax provisions would not be recognized within an “economic family.” The IRS since this ruling has abandoned its long standing position that premiums paid to captive insurance companies were not deductible under this “economic family” theory. The IRS continues to measure if a transaction lacks economic substance or is abusive using other methods of evaluation.

IRS Adds Safe Harbor on Risk Shifting and Distribution

In 2002, three revenue rulings were issued by the IRS on captive insurance taxation. Revenue Ruling 2002-89 (50% unrelated risk qualifies as sufficient risk distribution to be considered an insurance company), 2002-90 (finding 12 subsidiary companies where no one subsidiary makes up more than 15% of total premium qualifies even though all are related party affiliated companies), and 2002-91 (finding 7 unrelated insureds part of a group captive sufficed for risk shifting and risk distribution).

Many court cases are more liberal than these three “safe harbor” revenue rulings. However if you can design captive insurance company structures to meet these safe harbors, the captive will likely be approved for favorable tax treatment by the IRS if it is reviewed. Advanced captive planning coordinated with estate and business succession plans often incorporate captives owned by successor generations and/or management of the parent owners to facilitate business and financial objectives. Courts like the US sixth Circuit in Crawford Fitting Co. vs. US have found risk shifting under these circumstances.

2008 Revenue Ruling Impacting Cell Captives

The IRS issued Revenue Ruling 2008-8 (January 2008) to give some clarity to structures known as “cell captives,” “rent-a-captives” and “protected cell captives.” A related ruling, 2008-19, accompanied 2008-8. These rulings are favorable on the increasing use of cell captive structures, very popular today, and more guidance should come on this from the IRS in the future to help effective use of cell captives by more companies.

More Taxation Information on SPC, Cell and Series Captives

For a detailed discussion on Segregated Portfolio Company taxation, Series LLC taxation and cell captive taxation, please click here.

Some Additional IRS Rulings to Consider

Revenue Ruling 2005-40 (risk distribution and disregarded entities for meeting the Rev. Rul. 2002-90 Rule of 12 safe harbor),Rev Rul. 2007-47 (what is a risk) and 2009-26 (reinsurance impact). The IRS's view in some of these revenue rulings will likely not be upheld if challenged in court, such as ignoring the legal and economic substance of extending coverage to include multiple single owner LLCs that are distinct legal entities with distinct businesses, assets and liabilities, and similarly aggregating for Rule of 12 audit review purposes separate limited partnerships that have the same general partner.

New proposed regulation in September 2011 would greatly impact cell and series captives. Many Private Letter Rulings have also been issued impacting captive design and operating structures.

2011 Codification of the Economic Substance Doctrine

Part of the Obama health care law added section 7701(o) to the Internal Revenue Code. This new section codifies an economic substance test previously developed by the various US courts. This new test requires meeting 2 prongs. While the statute states clearly it is not intending to modify and the IRS should follow existing case law concepts, this new statute may make it harder for captive designs and structures to meet the test. Extra care should be taken to with new captives and old to have documentation that clearly aims to meet these standards. The new law also enacts a new penalty for understatements of tax if the economic substance requirements are not met. See a recent article on this topic for more information by clicking here.

US Owned Foreign Insurance Companies

Most US owned captives domiciled offshore today are small micro-captives using the special elections under IRS code sections 953 and 831(b) to have the offshore captive taxed as a US company, and exempt all of the captives income from premiums from US income tax. See 831(b) captives for more information. International tax and the US tax laws applicable to controlled foreign companies is complex. The US Internal Revenue Code has a section called subpart F that impacts the tax treatment of controlled foreign companies and foreign sourced income. It also has provisions that modify related party income, passive foreign investment company earnings (which a captive can be considered depending on its investment earnings ratio to premium income), excise taxes on premiums paid to foreign insurers, and other considerations.

Pooling Arrangements

Many captive insurance company promoters and consultants are using “pooling” arrangements to meet the US safe harbor tests, particularly the more than 50% unrelated risk safe harbor. The business risk of using such pool structures include increased potential for unexpected loss experiences that could impede the projected economic benefit of the captive insurance program strategy. The risk distribution impact of pooling arrangements may be tested in future disputes if they are designed to inhibit claims and are designed purely for tax purposes. Not all pooling arrangements are identical and it may very well turn out some are effective to achieve risk distribution while others will fail.

Asset Protection, Estate Planning and Wealth Transfer Tax Benefits

There are valuable incidental benefits beyond typical income tax benefits of well designed captive insurance structures. These may include asset protection, business succession funding, estate planning, and family wealth transfer benefits. Click here to read a white paper on Estate Planning and Captive Insurance. For information on South Dakota Trusts, Trust Law and Estate Taxation Planning, click here.

Summary of Key Law Cases Impacting Captive Insurance Companies

Caveat: Please note that subsequent IRS rulings and case law impact the findings of some of these older cases. These are however generally considered the line of cases setting forth the framework for forming and operating insurance companies.

Helvering v. LeGierse, 312 U.S. 531 (1941). Established that both risk shifting and risk distribution are requirements for a contract to be treated as insurance.

Carnation Co. v. Com’r., 71 T.C. 400 (1978), aff’d, 640 F.2d 1010 (9th Cir. 1981), cert. denied, 454 U.S. 965 (1981). Denied a deduction for premiums paid by a parent corporation to an unrelated U.S. insurer to the extent the premiums were ceded (pursuant to a reinsurance arrangement) by the insurer to the parent’s wholly owned Bermuda captive. The court’s decision hinged on its determination that the captive wrote no unrelated risk, was inadequately capitalized and entered into an agreement under which the parent could be compelled to contribute additional capital to the captive.

Stearns-Roger Corp. v. Com’r, 577 F. Supp. 833 (D. Cob. 1984), aff’d, 774 F.2d 414 (10th Cir. 1985). The U.S. District Court held that premium payments by a parent to its wholly-owned captive subsidiary were not deductible based on the “economic family” doctrine. The 10th Circuit Court of Appeals supported the denial, but rejected the economic family argument.

Clougherty Packing Co. v. Com’r., 84 T.C. 948 (1985), aff’d, 811 F.2d 1297 (9th Cir. 1987). This complex Tax Court decision, disallowing captive premium deductions, touched on many controversial issues and resulted in wide differences of opinions among the 19 judges.

Crawford Fitting Co. v. U.S., 606 F. Supp. 136 (N.D. Ohio 1985). The court held that insurance premiums paid to a Captive by a group of separate corporations that were owned and controlled by a group of related individuals were deductible because the shareholder/policyholders of the captive were not so economically related that their separate financial transactions had to be aggregated and treated as the transactions of a single taxpayer.

Humana, Inc. v. Com’r, 881 F.2d 247 (6th Cir. 1989). The 6th Circuit Court of Appeals held that the brother-sister captive arrangement constituted insurance for federal income tax purposes and, as such, premium payments attributable to the risk exposures of the captive’s brother-sister entities (but not the parent) were deductible. The Court’s decision was based on the so-called “balance sheet” approach, under which risk shifting depends on the effect of the arrangement on the policyholder’s net assets.

Kidde Industries, Inc. v. U.S., 40 Fed. Cl. 42 (Cl. Ct. 1997). Applying the balance sheet approach articulated in Humana, the Court held that premium payments made by brother-sister entities to the captive were currently deductible. In contrast, payments made by divisions of the parent corporation did not constitute insurance premiums deductible under IRC §162.

The Harper Group v. Com’r, 96 T.C. 45 (1991), aff’d, 979 F.2d 1341 (9th Cir. 1992). The Tax Court held, and the 9th Circuit Court of Appeals affirmed, that risk shifting and risk distribution were present where the captive received 29 to 32 percent of its premiums from unrelated parties. As such, the captive arrangement was found to constitute insurance for federal income tax purposes and payments made to the captive were deductible under IRC §162.

Inverworid v. Com’r, T.C. Memo 1996-301, supplemented by, T.C. Memo 1997-226. Transacting offshore company’s business through a U.S. office found to constitute engaging in a U.S. business for federal income tax purposes.

United Parcel Service vs. Com’r, T.C. Memo 1999-268 (1999), rev’d, 254 F.3d 1014 (11th Cir. 2001). The 11th Circuit found that the Tax Court had improperly determined that a restructured program in which a shipping corporation transferred its “excess value charge” income and obligations to a Bermuda insurance company was a tax sham. The Tax Court opinion describes the economic-substance doctrine as follows, “This economic-substance doctrine, also called the sham-transaction doctrine, provides that a transaction ceases to merit tax respect when it has no ‘economic effects other than the creation of tax benefits.’ [Citations omitted]. Even if the transaction has economic effects, it must be disregarded if it has no business purpose and its motive is tax avoidance.”

Other Tax Considerations

In planning a captive program, be sure to give careful consideration in your feasibility study and business plan, and organizational and corporate governance documents, to the business purpose, the economic substance (IRC section 7701(o)), and the arm's length pricing of transactions (IRC section 482) to avoid IRS adjustments and possible penalties.

Importance of the Looming Self-Procurement, Independently Procured, Non-Admitted Retaliatory Premium Tax Issue Often Overlooked

Insurance regulatory bodies, particularly in the US, have historically financed insurance regulation by charging premium taxes on premiums paid insurance companies they licensed to sell insurance to residents and businesses in the state. For constitutional reasons, residents and businesses are able to buy insurance from out of state insurance companies under many circumstances. This includes captives. As discussed below, when a company in State A forms a captive in State (or Country) B, and buys insurance from the captive, whether or not State A can levy and collect premium taxes depends on the states laws and on the facts and circumstances of each situation. Generally if the captive does business wholly outside of State A, and negotiates the insurance contracts outside of State A, then State A would lack sufficient constitutional nexus to tax the captive in any way including premium taxes. State A may however have statutory authority to levy and collect from the business in State A that buys insurance from a related out of state captive.

Click here for an article on state retaliatory self-procurement captive premium taxes.

To read the full opinion of a 2001 Circuit Court decision over a controversy involving application of Texas's 4.85% independently procured insurance premium tax to Dow Chemical where the court upholds the US Supreme Court's Todd Shipyards ruling from the 1980s, click here. See a copy of a recent 2001 case, Dow Chemical, where Texas levied Dow Chemical $427,149 dollars for premium taxes on policies Dow purchased from insurance companies not admitted in Texas. In Dow Chemical, the Circuit Court confirmed the Todd Shipyard's constitutional doctrine established long ago by the US Supreme Court limited a state's capacity to tax an out of state company that does not conduct business within that state, negotiated its insurance arrangements outside of the state, and otherwise does not have the requisite constitutional nexus to become subject to the state's taxing powers. Most captives and their owners are not likely to have the resources needed to challenge a state's levy of self procurement premium tax on premiums paid an out of state captive.

The NAIC (US National Association of Insurance Commissioners) supports states extending their tax even to out of state insurers with no business presence in the state (See the NAIC's Amicus Curiae brief submitted in support of the State of Texas in the 2001 Dow Chemical by clicking here). The NAIC's "Nonadmitted Insurance Model Act," adopted by over 40 states since 1999, enables states to tax premiums (and levy insureds doing business in their state) paid out of state insurers on the portion of the premium fairly allocated to risks within the state.

The Dodd-Frank Act NRRA provisions attempt to streamline this compliance headache area by allowing only a "home state" of an insured to tax certain non-admitted insurance. Some states enterred compacts to share premiums with other states, many states are going it alone like Wisconsin and New York and intend to keep all such taxes. The NRRA provisions of the Dodd-Frank Act will need to be clarified, including whether or not they apply to captives which most industry experts believe they do not.

Click here to read more about the Dodd-Frank NRRA provisions.

Click here to read about retaliatory premium taxes and a state's right to tax out of state captive insurance companies.

Click here for a summary by state of surplus lines premium taxes most of which may be applicable to a non-admitted captive insurer writing insurance to cover risks in those states.

Captive or Not To Captive

This brief introductory overview is meant to alert you to the many ways a captive can be taxed. Its impact on consolidated tax returns is complex as are related elections. Sometimes it may prove sufficient, even more attractive ,to simply retain risk and earn possible underwriting income in a non-insurance operating company verses transferring that risk to a captive and earning the profits there. Tax and regulatory considerations must be evaluated correctly and considered along with all the other pros and cons of starting up or participating in an existing captive program.

******* Please contact us if you would like to discuss these matters further or need a referral to qualified tax experts to help you navigate these complex but beneficial waters.